How Do I Invest In Tesla: A Beginner's Guide To Jumpstart Your Investment Journey

Investing in Tesla has become one of the hottest topics in the financial world today. Whether you're a seasoned investor or just starting out, the idea of owning a piece of this revolutionary company can be both exciting and intimidating. But don't worry, my friend, we've got you covered. In this article, we'll break down everything you need to know to confidently invest in Tesla, step by step.

Let’s face it, Tesla isn’t just any car company. It’s a tech powerhouse, a sustainability champion, and a brand that’s reshaping the way we think about transportation. If you’re thinking about how do I invest in Tesla, you’re not alone. Thousands of people are flocking to the stock market daily, hoping to get a slice of this electric vehicle giant.

But here’s the deal: investing isn’t just about throwing money at a company because it sounds cool. You need to understand the ins and outs, the risks, and the potential rewards. That’s why we’re here—to guide you through the process, so you can make informed decisions and grow your wealth like a pro.

- John C Mcginley From Platoon To Proud Dad Of Billie Grace

- Remote Iot Vpc Ssh Control Your Devices Securely Guide

Table of Contents

Why Tesla? Understanding the Appeal

How to Buy Tesla Stock: Step-by-Step Guide

- Debi Mazars Daughter Evelina From Runway To Italy Beyond

- Casey Kasems Daughter Liberty Kasem Today Family Drama

Best Platforms for Investing in Tesla

The Importance of Diversification

Current Market Trends Affecting Tesla

Tax Implications of Tesla Investments

Frequently Asked Questions About Tesla Investments

Why Tesla? Understanding the Appeal

When you think about electric vehicles, Tesla is the first name that comes to mind. But why exactly is Tesla so appealing to investors? Well, it’s not just about the cars. Tesla is at the forefront of renewable energy solutions, from solar panels to battery storage systems. The company’s mission to accelerate the world’s transition to sustainable energy resonates with investors who want to make a difference while also making a profit.

Plus, there’s Elon Musk, the charismatic CEO who’s turned Tesla into a global sensation. His bold vision and innovative approach have captured the imagination of millions. But beyond the hype, Tesla’s financial performance speaks for itself. The company has consistently delivered impressive quarterly results, making it one of the most valuable automakers in the world.

Key Reasons Why Investors Love Tesla

- Leadership in Electric Vehicle Technology

- Strong Brand Recognition

- Innovative Product Lineup

- Potential for Long-Term Growth

How to Buy Tesla Stock: Step-by-Step Guide

Alright, let’s get down to business. If you’re wondering how do I invest in Tesla, here’s a simple guide to help you get started. First things first, you’ll need to open a brokerage account. There are plenty of great platforms out there, from Robinhood to Schwab, so do your research and choose one that fits your needs.

Once you’ve set up your account, it’s time to fund it. Most platforms allow you to deposit money directly from your bank account. After that, you can start searching for Tesla stock, which trades under the ticker symbol TSLA. Place your order, and voila! You’re officially a Tesla shareholder.

Tips for Buying Tesla Stock

- Start with a small investment if you’re new to the market

- Consider setting up a recurring investment plan

- Monitor the stock regularly to stay informed

Tesla’s Origins: A Quick Bio

Before we dive deeper into investing, let’s take a moment to appreciate Tesla’s journey. Founded in 2003, Tesla was born out of a desire to create energy-efficient vehicles that could compete with traditional gas-powered cars. The company’s first product, the Roadster, was a game-changer, proving that electric cars could be both fast and stylish.

Over the years, Tesla has expanded its lineup to include models like the Model S, Model 3, Model X, and Model Y. Each vehicle showcases Tesla’s commitment to innovation and sustainability. But Tesla’s impact goes beyond cars. The company has also made waves in the energy sector with products like the Powerwall and Solar Roof.

Tesla’s Key Milestones

| Year | Event |

|---|---|

| 2003 | Company Founded |

| 2008 | First Roadster Delivered |

| 2012 | Model S Launch |

| 2017 | Model 3 Production Begins |

| 2020 | Tesla Joins the S&P 500 |

Best Platforms for Investing in Tesla

Now that you know how to invest in Tesla, let’s talk about where to do it. There are several platforms available, each with its own set of features and fees. Some popular options include:

- Robinhood: Great for beginners, no commission fees

- E*TRADE: Offers a wide range of investment tools and resources

- Charles Schwab: Known for its robust research capabilities

- Webull: Free trades and user-friendly interface

No matter which platform you choose, make sure it aligns with your investment goals and risk tolerance. And remember, always read the fine print to understand any fees or restrictions.

Assessing the Risk and Reward

Investing in Tesla can be highly rewarding, but it’s not without risks. Like any stock, Tesla’s price can fluctuate based on a variety of factors, including market conditions, company performance, and global events. While Tesla has a strong track record, there’s no guarantee of future success.

That’s why it’s important to assess your risk tolerance before diving in. If you’re comfortable with some volatility, Tesla could be a great addition to your portfolio. But if you prefer more stable investments, you might want to consider diversifying your holdings.

The Importance of Diversification

Speaking of diversification, let’s talk about why it’s so crucial. Putting all your eggs in one basket—like Tesla—can be risky. Even the most successful companies can face challenges, so it’s wise to spread your investments across different sectors and asset classes.

By diversifying, you can reduce your overall risk while still maintaining the potential for growth. Think of it like a safety net for your portfolio. It might not be as thrilling as betting everything on Tesla, but it’s a smart move in the long run.

Tesla’s Long-Term Potential

So, what does the future hold for Tesla? Experts believe the company has tremendous potential, thanks to its leadership in electric vehicles and renewable energy. As more countries commit to reducing carbon emissions, demand for Tesla’s products is expected to soar.

Additionally, Tesla’s expansion into new markets, such as China and Europe, opens up even more opportunities for growth. With advancements in battery technology and autonomous driving, the company is well-positioned to remain a dominant force in the industry for years to come.

Current Market Trends Affecting Tesla

As with any investment, it’s important to stay informed about market trends that could impact Tesla. Right now, factors like rising interest rates, supply chain disruptions, and geopolitical tensions are affecting the stock market as a whole. However, Tesla has shown resilience in the face of these challenges, thanks to its strong brand and innovative products.

Another trend to watch is the increasing adoption of electric vehicles worldwide. Governments are offering incentives to encourage the switch from gas-powered cars, which could further boost Tesla’s sales. Keep an eye on these trends to make informed decisions about your Tesla investments.

Tax Implications of Tesla Investments

Let’s not forget about taxes. Depending on how you invest in Tesla, you may be subject to capital gains taxes when you sell your shares. The amount you owe will depend on how long you’ve held the stock and your tax bracket.

To minimize your tax burden, consider using tax-advantaged accounts like IRAs or 401(k)s. These accounts allow your investments to grow tax-free or tax-deferred, providing significant savings over time. Always consult with a tax professional to ensure you’re maximizing your benefits.

Frequently Asked Questions About Tesla Investments

How Much Money Do I Need to Invest in Tesla?

Thanks to fractional shares, you can invest in Tesla with as little as $1. However, it’s generally a good idea to start with a larger amount if you’re serious about building wealth.

Is Tesla a Good Long-Term Investment?

Absolutely! With its innovative products and strong market position, Tesla has the potential to deliver solid returns over the long term. Just remember to diversify your portfolio to manage risk.

Can I Invest in Tesla Without a Broker?

Technically, yes. You can purchase Tesla stock through direct stock purchase plans, but this method is less common and may have limitations. Using a broker is usually the easiest and most flexible option.

Conclusion

Investing in Tesla can be a rewarding experience, but it requires knowledge, strategy, and a bit of patience. By following the steps outlined in this guide, you’ll be well on your way to becoming a savvy Tesla investor. Remember to do your research, assess your risks, and diversify your portfolio for the best results.

So, what are you waiting for? Dive into the world of Tesla investments and start building your financial future today. And don’t forget to share your thoughts and experiences in the comments below. We’d love to hear from you!

- Woojins Stray Kids Exit What Really Happened Solo Career

- Who Is Francesca Fataar Unveiling Her Life Legacy Today

107037024164824418720220325t213023z_1516440795_rc2x9t9fbjme_rtrmadp

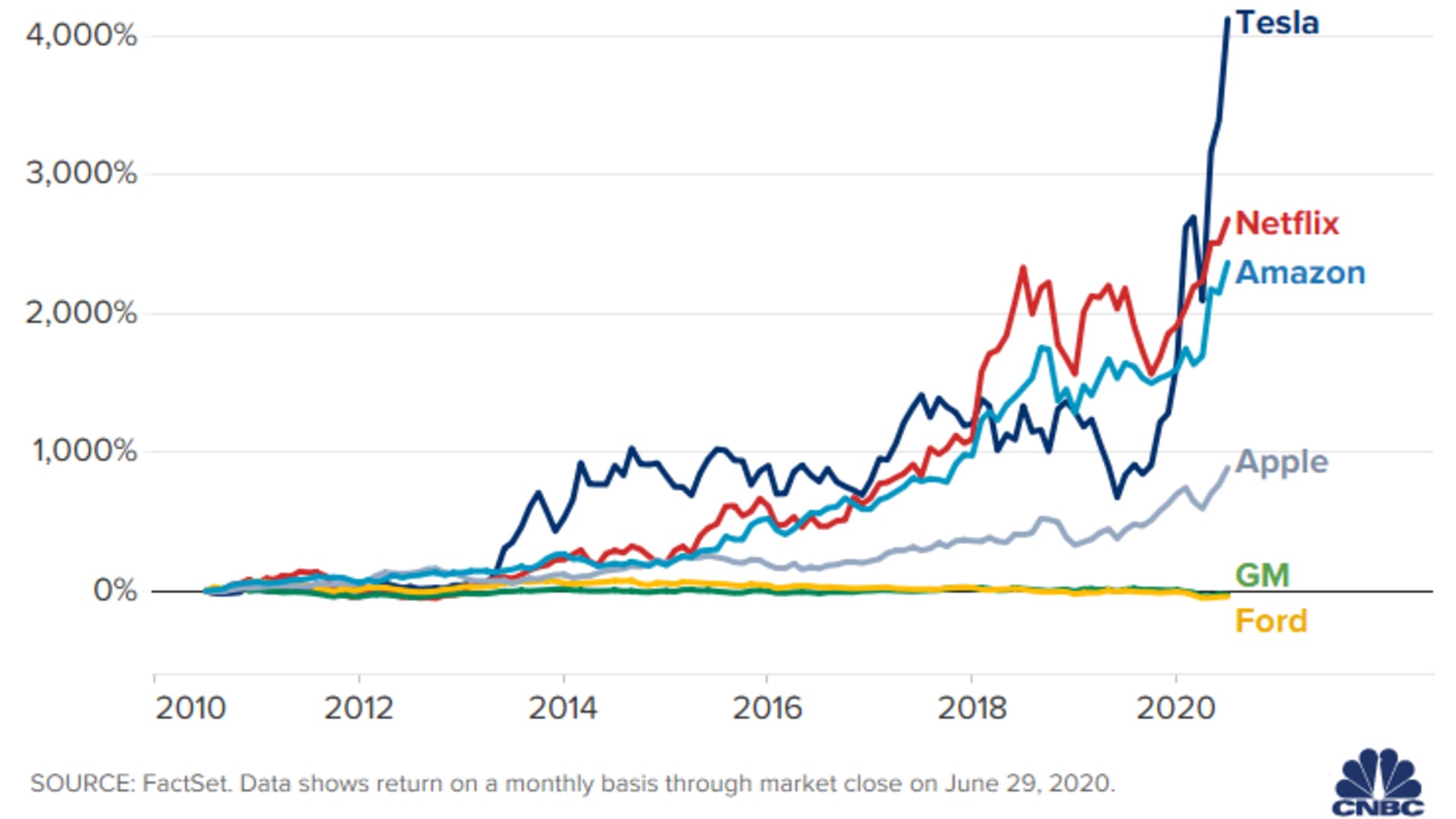

Tesla stock up 4125 since IPO ten years ago

ETC. Positive Living The viral claim about a “Tesla Pi phone” with