How To Invest Into Tesla: A Beginner’s Guide To Building Wealth With Elon’s Empire

Investing in Tesla can be your ticket to financial success, but where do you start? If you’ve ever wondered how to invest in Tesla and make the most of its skyrocketing growth, you’re not alone. In this article, we’ll break down everything you need to know, from understanding Tesla’s market presence to navigating the investment process.

Let’s face it, Tesla isn’t just another car company—it’s a revolution in the making. With Elon Musk at the helm, Tesla has transformed from a niche electric vehicle manufacturer into a global powerhouse. But before you jump into the stock market, it’s crucial to understand the ins and outs of investing in Tesla.

This guide is designed to help you navigate the complexities of Tesla investments, whether you’re a seasoned investor or a complete newbie. We’ll cover everything from stock options to long-term strategies, ensuring you’re well-equipped to make informed decisions.

Understanding Tesla: The Driving Force Behind Its Success

Tesla’s Mission and Vision

Before diving into how to invest into Tesla, it’s important to grasp what makes this company so unique. Tesla’s mission is clear: accelerate the world’s transition to sustainable energy. This vision extends beyond electric vehicles (EVs) to include energy storage solutions, solar panels, and even autonomous driving technology.

Tesla’s success isn’t just about making cool cars; it’s about redefining the future of transportation and energy. With innovations like the Model S, Model 3, Model X, and Model Y, Tesla has captured the hearts of consumers worldwide. And let’s not forget the Cybertruck, which promises to disrupt the truck market.

Tesla’s Market Position

Tesla dominates the EV market, accounting for a significant share of global sales. According to BloombergNEF, Tesla holds over 20% of the global EV market, making it the leader in this rapidly growing industry. But it’s not just about cars—Tesla’s energy storage solutions, such as the Powerwall and Powerpack, are gaining traction as well.

- Roz Varons Heartbreak Remembering Sara Her Legacy

- Uofls Cardbox Free Cloud Storage Amp Collaboration Guide

Here are some key stats to consider:

- Tesla delivered over 1.3 million vehicles in 2022.

- The company has a market capitalization exceeding $700 billion as of early 2023.

- Tesla’s Gigafactories are expanding globally, ensuring a steady supply of batteries and vehicles.

Why Should You Invest in Tesla?

Long-Term Growth Potential

Tesla’s growth trajectory is nothing short of impressive. The company continues to expand its product lineup, enter new markets, and innovate at an unprecedented pace. For investors, this means significant long-term potential. Analysts predict that Tesla’s revenue could reach $100 billion by the end of the decade, driven by increasing demand for EVs and energy solutions.

But it’s not just about numbers. Tesla’s brand loyalty is unmatched. Customers are passionate about the company’s mission and products, creating a strong community that drives sales and innovation.

Elon Musk’s Visionary Leadership

Elon Musk’s leadership plays a crucial role in Tesla’s success. Known for his ambitious goals and disruptive thinking, Musk has positioned Tesla as a leader in multiple industries. From launching rockets with SpaceX to revolutionizing transportation with Tesla, Musk’s vision extends far beyond traditional business boundaries.

Investing in Tesla is, in many ways, investing in Musk’s vision for the future. His ability to push boundaries and challenge the status quo has consistently driven Tesla to new heights.

Step-by-Step Guide to Investing in Tesla

1. Research and Understand Tesla’s Stock

Before buying Tesla stock, it’s essential to understand what you’re investing in. Tesla trades on the NASDAQ under the ticker symbol TSLA. As of early 2023, Tesla’s stock price has fluctuated significantly, making it both an exciting and risky investment.

Key points to consider:

- Tesla’s stock price has seen dramatic swings, partly due to Musk’s tweets and market sentiment.

- The company’s revenue and profitability have been on an upward trend, but it’s important to analyze quarterly earnings reports.

- Tesla’s stock is classified as a growth stock, meaning it has high potential for future earnings but also comes with higher risk.

2. Choose the Right Broker

Selecting the right brokerage platform is crucial for a smooth investment experience. Some popular options for buying Tesla stock include:

- Robinhood: Known for its commission-free trading, Robinhood is a great choice for beginners.

- Charles Schwab: Offers a wide range of investment options and tools for analyzing stocks.

- E*TRADE: Provides advanced trading features and educational resources for investors.

When choosing a broker, consider factors like fees, user interface, and available resources. Many platforms offer demo accounts, allowing you to practice trading before committing real money.

3. Decide on Your Investment Strategy

There are several ways to invest in Tesla, depending on your financial goals and risk tolerance:

- Buy and Hold: Ideal for long-term investors who believe in Tesla’s future growth.

- Dollar-Cost Averaging: Involves investing a fixed amount of money regularly, reducing the impact of market volatility.

- Options Trading: Advanced investors can use options to speculate on Tesla’s stock price movements.

It’s important to align your strategy with your financial objectives and risk appetite. Consulting with a financial advisor can also provide valuable insights.

Understanding Tesla’s Stock Performance

Historical Stock Price Trends

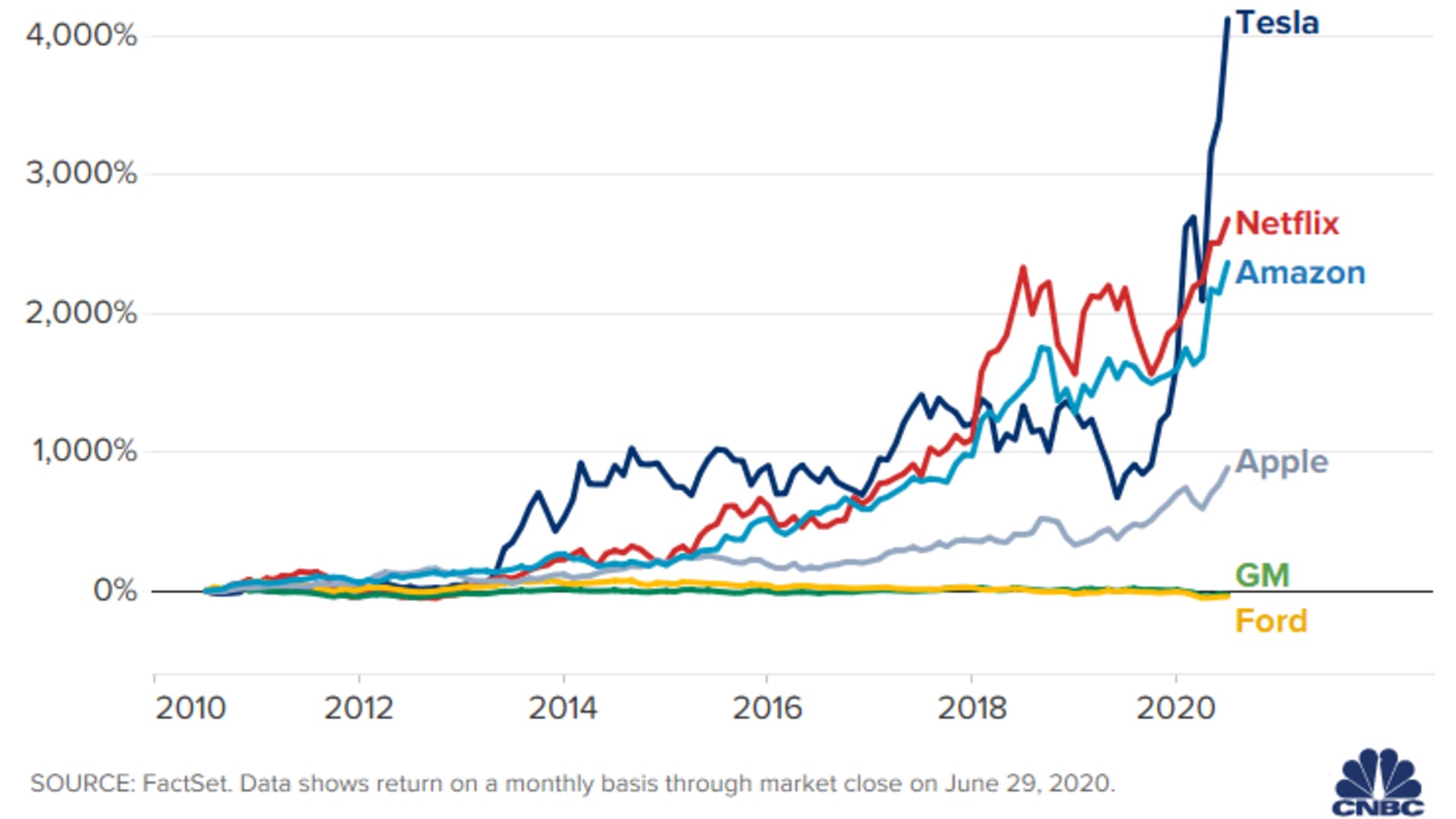

Tesla’s stock price has experienced remarkable growth since its IPO in 2010. Initially priced at $17 per share, Tesla’s stock skyrocketed to over $1,200 per share in 2020 before undergoing a 5-for-1 stock split. Since then, the stock has continued to fluctuate, reflecting both market sentiment and company performance.

Key milestones in Tesla’s stock price history:

- 2013: Tesla’s stock price surpassed $100 for the first time.

- 2017: The company achieved profitability, driving stock prices higher.

- 2020: Tesla joined the S&P 500 index, further boosting its stock price.

Factors Influencing Tesla’s Stock Price

Several factors contribute to Tesla’s stock price movements:

- Production and Delivery Numbers: Quarterly reports on vehicle production and deliveries heavily influence investor sentiment.

- Elon Musk’s Tweets: Musk’s social media activity often impacts Tesla’s stock price, both positively and negatively.

- Regulatory Developments: Government policies on EVs and renewable energy can affect Tesla’s growth prospects.

Staying informed about these factors can help you make better investment decisions.

Risks and Challenges of Investing in Tesla

Market Volatility

Tesla’s stock is known for its volatility, making it both exciting and risky. Factors like economic conditions, geopolitical events, and company-specific news can cause significant price swings. For example, Musk’s acquisition of Twitter in 2022 led to concerns about his focus on Tesla, impacting the stock price.

It’s important to have a long-term perspective when investing in Tesla. Short-term fluctuations shouldn’t deter you from your investment goals.

Competition in the EV Market

While Tesla leads the EV market, competition is intensifying. Companies like Ford, GM, and Rivian are ramping up their EV offerings, challenging Tesla’s dominance. Additionally, Chinese manufacturers like NIO and XPeng are gaining ground in the global market.

Investors should monitor these developments and assess their potential impact on Tesla’s market position.

Alternative Ways to Invest in Tesla

ETFs and Mutual Funds

If you’re hesitant to invest directly in Tesla stock, consider exchange-traded funds (ETFs) or mutual funds that include Tesla in their portfolios. These options provide diversification and reduce risk. Some popular ETFs with Tesla exposure include:

- Invesco QQQ ETF: Tracks the Nasdaq-100 Index, which includes Tesla.

- ARK Innovation ETF: Focuses on disruptive innovation, with Tesla as a major holding.

Options and Derivatives

For experienced investors, options and derivatives offer opportunities to speculate on Tesla’s stock price movements. However, these instruments come with significant risks and require a deep understanding of financial markets.

Before venturing into options trading, ensure you fully comprehend the mechanics and potential outcomes.

Conclusion: Take the Leap and Invest in Tesla

In summary, investing in Tesla can be a rewarding journey, but it requires careful consideration and a long-term perspective. By understanding Tesla’s mission, market position, and stock performance, you can make informed decisions about your investment strategy.

Remember, investing in Tesla isn’t just about buying stock—it’s about believing in a vision for the future. Whether you’re a beginner or a seasoned investor, there’s something for everyone in Tesla’s world.

So, what are you waiting for? Dive into the world of Tesla investments and take the first step toward building your financial future. Don’t forget to share your thoughts in the comments below and check out our other articles for more investment insights!

Table of Contents

- How to Invest Into Tesla: A Beginner’s Guide to Building Wealth with Elon’s Empire

- Understanding Tesla: The Driving Force Behind Its Success

- Tesla’s Mission and Vision

- Tesla’s Market Position

- Why Should You Invest in Tesla?

- Long-Term Growth Potential

- Elon Musk’s Visionary Leadership

- Step-by-Step Guide to Investing in Tesla

- Research and Understand Tesla’s Stock

- Choose the Right Broker

- Decide on Your Investment Strategy

- Understanding Tesla’s Stock Performance

- Historical Stock Price Trends

- Factors Influencing Tesla’s Stock Price

- Risks and Challenges of Investing in Tesla

- Market Volatility

- Competition in the EV Market

- Alternative Ways to Invest in Tesla

- ETFs and Mutual Funds

- Options and Derivatives

- Somali Telegram Links 2025 Find Groups Channels More

- Boost After Gravityinternetnet Start Guide 2024

107037024164824418720220325t213023z_1516440795_rc2x9t9fbjme_rtrmadp

Tesla stock up 4125 since IPO ten years ago

ETC. Positive Living The viral claim about a “Tesla Pi phone” with